As we enter the 2024/2025 fiscal year, the budget that the N.C. General Assembly passed last year provided state employees with a 3 percent salary increase for 2024/2025 effective July 1.

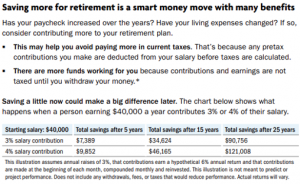

When your paycheck gets a raise, it’s a great opportunity to give your retirement plan a raise as well. As TIAA has shown in the provided illustration, saving a little more now can make a huge difference in the future. Even a 1 percent increase to your UNC Supplemental 403(b) or 457(b) plan each year could add thousands to your account over time. For more information from TIAA on giving your retirement plan a raise, click here.

Are you interested in saving more but not sure where to begin? The UNC System offers the opportunity to meet one-on-one with our investment advisory firm, CAPTRUST, to create your Retirement Blueprint. In addition, you can also contact TIAA directly to schedule a meeting with one of our dedicated TIAA Financial Consultants. To contact TIAA or CAPTRUST to schedule your one-on-one meeting, see the contact chart below.

For more information on the UNC Supplemental Retirement options, click here to review our Supplemental Retirement Plan Decision Guide.

To begin contributing to a UNC Supplemental 403(b) or 457(b) to better prepare for retirement, complete the corresponding 403(b) or 457(b) form below and turn it in to your institution’s Benefits office. In addition to completing this form, log in to TIAA.org/unc and select “Enroll Now” to set up your account, choose your investments, and select your beneficiaries.

To simply increase your 403(b) or 457(b) contributions, complete the corresponding forms and return to your institution’s Benefits office.