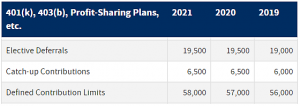

The tax law places limits on the dollar amount of contributions to retirement plans and IRAs and the amount of benefits under a pension plan. IRC Section 415 requires the limits to be adjusted annually for cost-of-living increases.

The limit on contributions by employees who participate in 401(k), 403(b), and most 457 plans remains unchanged in 2021 at $19,500.

The catch-up contribution limit for employees aged 50 and over who participate in these plans remains unchanged at $6,500.

See chart or visit the Internal Revenue Service website for more details on historical and current contribution limits.