Welcome to Open Enrollment for 2025!

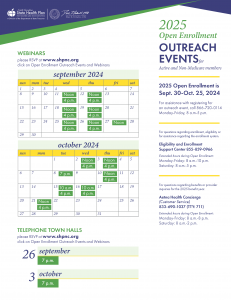

Open enrollment runs Sept. 30 – Oct. 25, with changes effective Jan. 1, 2025.

Open enrollment is the time of year to ensure current elections best meet the needs of you and your family. In addition to reviewing your benefits, consider other items such as verifying your beneficiaries or increasing your contributions to your retirement savings.

There are minimal changes to the State Health Plan, NCFlex plans, and UNC System benefits for the coming plan year. In addition to open enrollment information provided to you by your institution, open enrollment materials will be mailed to employees’ homes from the State Health Plan and NCFlex.

Learn more about 2025 benefit changes and how you can make changes in your coverage(s) below.

Important 2025 Open Enrollment Information

- All NCFlex and UNC supplemental plan enrollment will be on the UNC Empyrean benefits enrollment

platform for all benefits-eligible university employees. This means employees will use two enrollment platforms to complete their desired open enrollment actions. - NEW for 2025: The State Health Plan will be transitioning to Aetna on Jan. 1, 2025. As a result,

employees must log in to eBenefits (BenefitFocus) during Open Enrollment to designate their primary

care provider under Aetna. - Rate reduction: The UNC supplemental disability plan offered by The Standard, available only to Optional Retirement Plan participants, will see a 7 percent rate reduction.

State Health Plan

The State Health Plan will maintain its current premium rates for the 2025 plan year. As in prior years, all permanent employees must enroll in the Enhanced PPO (80/20) plan if you do not want to remain in the Base PPO (70/30) plan for the 2025 plan year.

Click on the links below for more information about plan benefits, opportunities to attend online enrollment meetings, the 2025 transition to Aetna as the third-party administrator (TPA) of the State Health Plan, and Tobacco Attestation information to receive the $60 tobacco wellness credit.

- State Health Plan 2025 open enrollment

- Tobacco Users – Tobacco Cessation Wellness Credit Information

- 2025 transition to Aetna as TPA

- Employee Education Sessions

State Health Plan Updates and Reminders

- No employee premium rate changes for the NC State Health Plan Base PPO (70/30) and Enhanced PPO (80/20) medical plans.

- Employees can complete the Tobacco Cessation counseling requirement before annual enrollment to receive the $60 tobacco wellness credit. For more information and instructions, see the link above.

- The State Health Plan is transitioning its third-party administrator from Blue Cross NC to Aetna effective Jan. 1, 2025. All members will need to re-select a primary care provider to keep enjoying lower copays when visiting that provider.

NCFlex Plans

NCFlex will maintain its current benefit offerings for the 2025 plan year; however, some plans may have experienced rate changes. If you do not enroll for the first time or make a plan change, your current benefits will roll over, except for the Flexible Spending Accounts (health care and dependent day care), which require re-enrollment. For the 2025 plan year, the Healthcare Flexible Spending Account (FSA) annual limit is $3,200 with a $640 rollover balance.

will roll over, except for the Flexible Spending Accounts (health care and dependent day care), which require re-enrollment. For the 2025 plan year, the Healthcare Flexible Spending Account (FSA) annual limit is $3,200 with a $640 rollover balance.

For benefit plan information, click on the 2025 University NCFlex Guide or visit the NCFlex website.

NCFlex will send enrollment communications to employees’ homes throughout open enrollment. Several online webinars for employees to learn more about the plans and changes for 2025 will also be available.

NCFlex Updates and Reminders

- MetLife Dental rates for all coverage options will increase for 2025. There are no waiting periods to change dental plans.

- 2025 health care flexible spending account (FSA) limit is $3,200. The rollover balance is $640. To view your current FSA balance, log into the NCFlex P&A Admin site.

- Neither the Cancer nor Critical Illness plans require evidence of insurability to enroll.

- Review the NCFlex guide for rate and plan information.

UNC System Income Protection Programs

The University provides several programs that can help protect your income streams in case of disability or death.

UNC System Group Term Life Insurance and Accidental Death & Dismemberment (AD&D)

The UNC System has partnered with Securian Financial to provide a consolidated life insurance plan that offers coverage for employees, spouses or domestic partners, and dependent children.

The UNC System has partnered with Securian Financial to provide a consolidated life insurance plan that offers coverage for employees, spouses or domestic partners, and dependent children.

UNC Supplemental Disability Plans

In addition to the health and welfare plans that are offered, the University also extends disability plan benefits through Lincoln for employees enrolled in the Teacher and State Employees’ Retirement System (TSERS) and The Standard for employees in the Optional Retirement Plan. Take this opportunity to consider enrollment in these significant benefits. Each benefit will pay up to 66 2/3%. The benefit also supplements disability benefits available to you through TSERS for employees with at least one year of service.

Visit the Income Protection Benefits page on the UNC System HR website for important information about these available income protection plan options, special plan features and services, and costs for coverage. You can also use the provided flyers and online calculator tools to calculate your estimated monthly premium payment, which will be conveniently deducted from your paycheck.

UNC System Plan updates and reminders

- The UNC supplemental disability plan offered by The Standard, available only to Optional Retirement Plan participants, will see a 7 percent rate reduction. There is no change to the Lincoln Financial supplemental disability plan rate.

- As a reminder, during Open Enrollment, if you are not currently enrolled and want to enroll in coverage for the first time, or you are requesting life insurance coverage over the guaranteed issue amount, Evidence of Insurability (EOI) will be required.

- Review the UNC Income Protection Benefits site for more rate and plan information.

As a reminder, the benefits listed represent the core plans offered by the State of North Carolina and the University of North Carolina System. Contact your institution’s benefits representative for other supplemental benefits that may be available on your campus.

How to Enroll:

Enrollment in these plans is easy. Log into the Single Sign-On for your institution and follow the online instructions to complete your State Health Plan, NCFlex plans, and UNC plans enrollment.

eBenefits (BenefitFocus) Enrollment Platform:

- To enroll in the NC State Health Plan, log in to the eBenefits (BenefitFocus) platform.

- Update your State Health Plan enrollment from Base PPO (70/30) to Enhanced PPO (80/20) if you do not want to stay in the Base PPO (70/30) Plan.

- Complete the Tobacco Attestation as part of your State Health Plan enrollment in eBenefits. For tobacco users to receive the $60 wellness credit, you must follow the instructions for the Tobacco Cessation counseling requirement.

- Re-select your primary care provider to keep enjoying lower copays when visiting your provider.

- Verify your dependents. If you are enrolling dependents for the first time, make sure you have their Social Security numbers, and approved documentation. For a complete list of approved documents go to List of Required Documentation for Dependent Eligibility.

UNC Empyrean Enrollment Platform:

- Review and update your beneficiaries if applicable for the UNC voluntary life and AD&D plans as well as the NCFlex Cancer and Critical Illness plans.

- To enroll in any NCFlex plans (dental, vision, FSA [health care and/or dependent day care], accident, cancer, critical illness, or TRICARE supplement) log in to the UNC Empyrean platform.

- Enroll or re-enroll in the Flexible Spending Account for health care and/or dependent day care.

- To enroll in any UNC Income Protection plans (UNC voluntary life, UNC voluntary AD&D, UNC supplemental disability plans) log in to the UNC Empyrean platform.

Save your enrollment changes and print your annual enrollment confirmation statements from both platforms to confirm that you have taken an enrollment action.

Are You On Target to Reach Your Retirement Goals?

During enrollment, you’ll be thinking about the health benefits you need for the coming year. It’s also a good time to think about your retirement benefits.

The month of October is designated as National Retirement Security Month. This is a great time to make sure your retirement savings and investments are still on track to meet your future goals. Learning more about specific financial needs in retirement is a good place to start and can help you make more effective decisions. Grow your financial knowledge by registering for one or more live webinars offered by TIAA and/or CAPTRUST to learn more about ways to save and retire securely. A full list of upcoming webinars is provided here.

This is the perfect time to consider your participation in the UNC retirement program and whether you are on target to reach your financial goals. In addition, take advantage of these UNC resources:

- TIAA/UNC System 403(b) and 457(b): Watch the supplemental plan video.

- CAPTRUST: All UNC System retirement program participants have access to CAPTRUST’s independent financial advisers. These advisors can help you plan for retirement and help you choose the right investment options offered under the UNC System retirement program. Visit CAPTRUST At Work or call 800-967-9948.

- UNC’s Supplemental Retirement Plans offer another way for you to boost your savings even more. Learn more about the UNC Supplemental Retirement Plans and how they can help you reach your personal retirement savings goals.

2025 Open Enrollment Resources

University Open Enrollment Summary Guide

University of North Carolina NCFlex Benefits Guide

Open Enrollment Links: Single Sign-On by Institution

UNC Empyrean (COMPASS) Open Enrollment Election Job Aid

State Health Plan Comparison Chart

State Health Plan Rates for the Enhanced PPO (80/20) and Base PPO (70/30) Plans

Supplemental Retirement Savings Plan Information

UNC System Income Protection Programs

Enrollment Reminders

Did you complete the Tobacco Attestation?

Did you re-select your primary care provider?

Did you re-enroll in the Flexible Spending Accounts for healthcare and day care for 2025?

Did you save your enrollment elections and download your enrollment confirmation statement from BenefitFocus and/or the Empyrean platforms?

Did you update your beneficiaries?

Did you consider participating or increasing contributions into a UNC System Supplemental Retirement Savings plan?

Did you participate in a NCFlex or State Health Plan enrollment information webinar?

Did you check to see if your PCP is part of the State Health Plan’s Clear Pricing Provider Program for co-pay savings?