With today’s technological advances and increased mindfulness on health and wellbeing many are living longer and healthier life spans. Today’s retirees are more likely than previous generations to have an active retirement lifestyle.

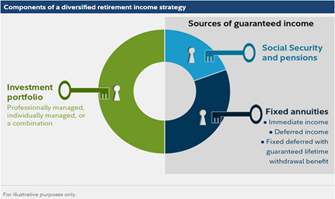

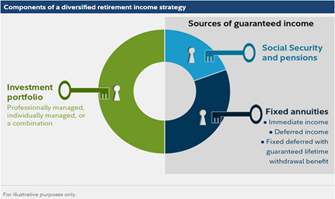

So, what are the keys to building a retirement income plan that can last? Fidelity shares that you should build income plans with guaranteed income, growth potential and flexibility in mind. They believe a solid retirement income plan should provide:

- Guarantees to ensure core expenses are covered

- Growth potential to meet long-term needs and legacy goals

- Flexibility to refine your plan as needed over time

Read more about these three essential building blocks for building a retirement income plan by visiting Fidelity’s Viewpoints articles online. Also consider working with one of the UNC Supplemental Retirement vendors to build your retirement income plan.

Fidelity (schedule-a-meeting or 800-343-0860) and TIAA (www.tiaa.org/unc or 855-400-4294)